A term sheet outlines the basic terms and conditions of an investment opportunity and is a non-binding agreement that serves as a starting point for more detailed agreements – like a commitment letter, definitive agreement (share purchase agreement), or subscription agreement. Term sheets are often produced by investment bankers on behalf of corporate issuers. Download our free Term Sheet Template.

Download CFI’s free term sheet template now to advance your finance knowledge.

Note: This term sheet is only for educational purposes and should not be used for any other purpose.

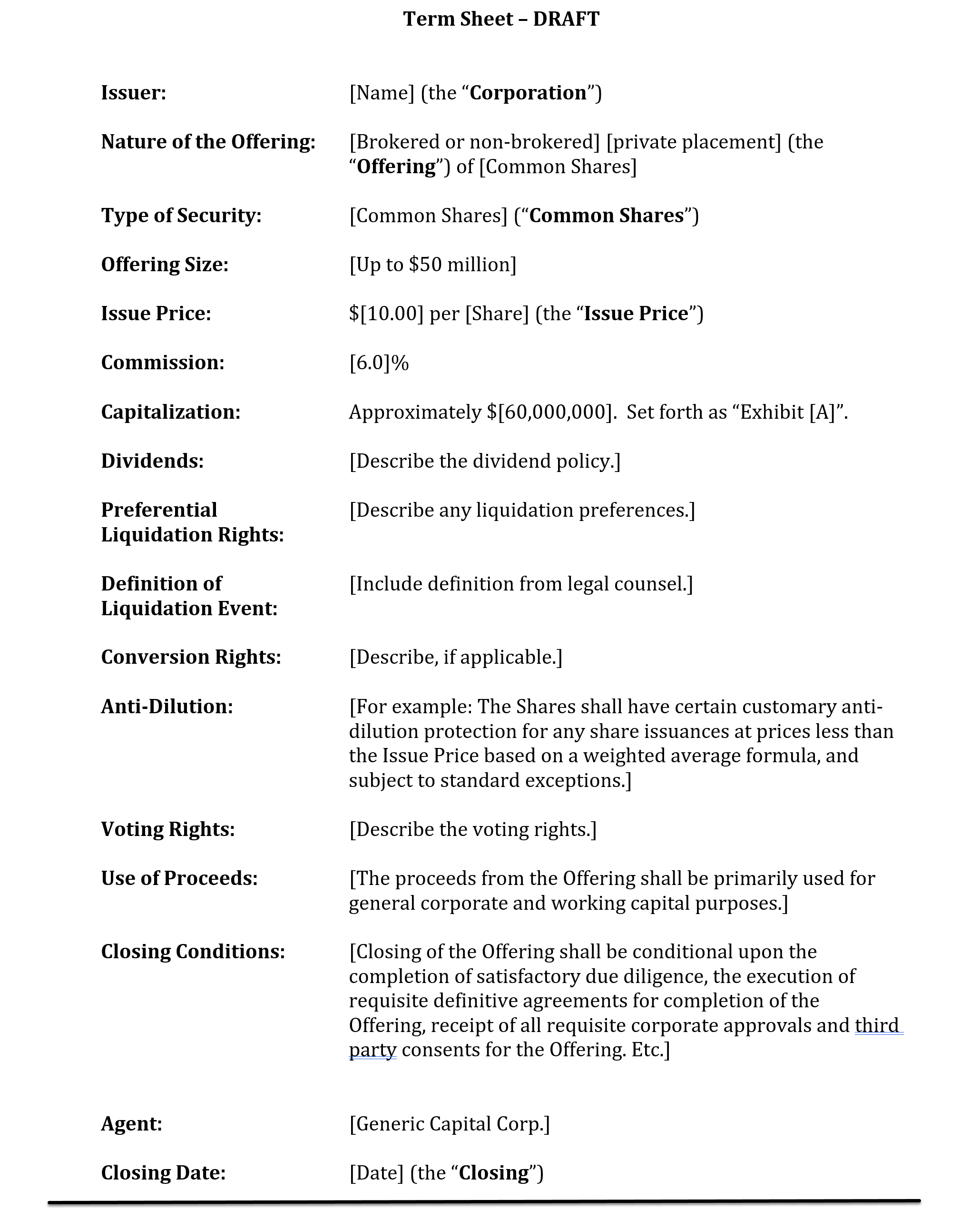

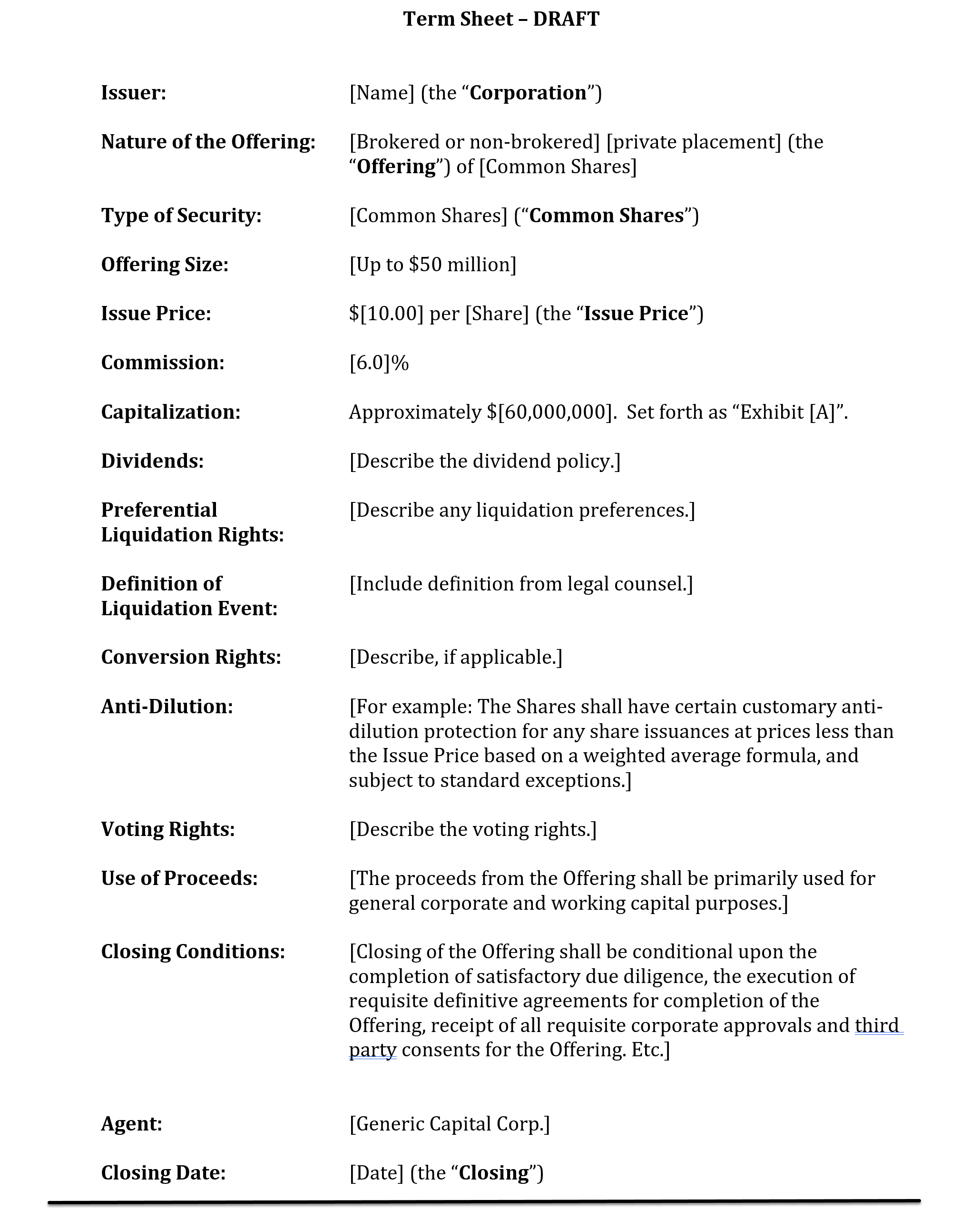

Issuer: [Name] (the “Corporation”)

Nature of the Offering: [Brokered or non-brokered] [private placement] (the “Offering”) of [Common Shares].

Type of Security: [Common Shares]

Offering Size: [Up to $50 million]

Issue Price: $[10.00] per [Share] (the “Issue Price”).

Commission: [6.0]%

Capitalization: Approximately $[60,000,000]. Set forth as “Exhibit [A]”.

Dividends: [Describe the dividend policy.]

Preferential Liquidation Rights: [Describe any liquidation preferences.]

Definition of Liquidation Event: [Include definition from legal counsel.]

Conversion Rights: [Describe, if applicable.]

Anti-Dilution: [For example: The Shares shall have certain customary anti-dilution protection for any share issuances at prices less than the Issue Price based on a weighted average formula, and subject to standard exceptions.]

Voting Rights: [Describe the voting rights.]

Use of Proceeds: [The proceeds from the Offering shall be primarily used for general corporate and working capital purposes.]

Closing Conditions: [Closing of the Offering shall be conditional upon the completion of satisfactory due diligence, the execution of requisite definitive agreements for completion of the Offering, receipt of all requisite corporate approvals and third party consents for the Offering. Etc.]

Agent: [Generic Capital Corp.]

Closing Date: [Date]

Note: This term sheet is only for educational purposes and should not be used for any other purpose.

Wondering where the term sheet fits in the overall process of raising capital for private companies?

Here is a list of all the main documents in private capital raising:

Typically, the investment bankers or advisors on the transaction will send people a Teaser or single-page marketing document outlining the investment opportunity. If investors are interested, they will sign an NDA and receive more detailed information such as the management presentation, an offering memorandum, and a Term Sheet. The final stage will be a Subscription Agreement.

Knowing how to build a term sheet is an important investment banking skill-set.

In order to prepare for a career in investment banking, corporate development, or private equity you may find these resources helpful:

To find out more, check out our interactive Career Map. See also our valuation resources and commercial lending resources.